do pastors pay taxes on their income

When a minister works for a church the church can withhold income tax. Churches who earn an unrelated business gross taxable income of 1000.

Understanding Taxation Of Religious Organizations By Daniel Goldman Politicoid Medium

June 7 2019 303 PM.

. Federal Income Tax. A licensed commissioned or ordained minister is generally the common law employee of the church denomination sect or organization that. Ministers pastors and other members of the clergy are required to pay Federal Income tax on their salary.

The minister however must pay the Medicare and Social Security taxes herself in a self. The payments officially designated as a housing allowance must be used in the year received. The church would provide a W-2 for.

417 Earnings for Clergy. However if the speaking engagement is part of regular church service it would be considered part of the pastors main employment income for the church. They are considered a common law employee of the church so although they do receive a W2 their.

The parsonage allowance is a tax exemption from income while mortgage interest and property taxes are tax deductions from income. Section 107 of the Internal Revenue Code clearly allows only. Churches who earn an.

1 Best answer. What taxes are pastors exempt from. Unfortunately the rules for clergy income taxes can be especially confusing.

One may not opt out of. Pastors are exempt from income tax withholding and are not obligated to have federal taxes withheld from their paychecks. They may designate a portion of their.

Not every staff member at the church can take this allowance. Do pastors and priests pay taxes. According to the Internal Revenue Service IRS pastors provide ministerial services usually as common-law employees of a church organization denomination or sect.

Nonprofit organizations and churches do not have to pay income taxes on unearned income. Yes pastors pay federal income tax. Pastors may voluntarily choose to ask their.

Answered as a US tax specialist and the spouse of a man who worked exclusively as a Presbyterian pastor for 13 years. Answer 1 of 3. But clergy are both exempt from federal income tax withholding and considered self-employed for Social Security tax purposes.

Include any amount of the allowance that you cant exclude as wages on line 1 of Form 1040. Pastors fall under the clergy rules. The housing allowance is for pastorsministers only.

While it is true that churches merely by the virtue of truly being churches enjoy tax-exempt status from federal corporate taxes that does not mean that churches do not pay taxes at all. Clergy must pay income taxes just like everyone else.

Ultimate Tax Guide For Ministers The Official Blog Of Taxslayer

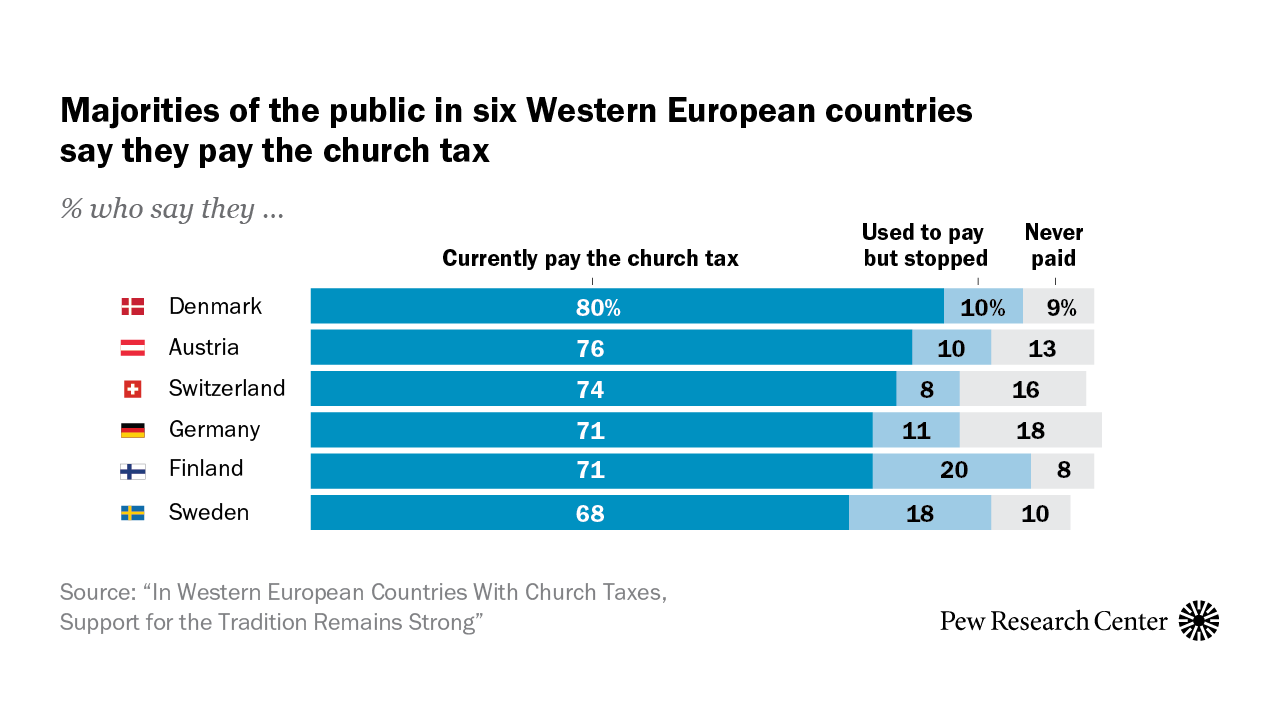

Church Taxes In Western Europe Key Takeaways Pew Research Center

Startchurch Blog 3 Major Tax Benefits For Pastors

Chairman S Report March 29 2019 Fairtax Fairtax Org

Pastors On Why Churches Must Pay Taxes Biblical Or Economical

How To Determine If A Pastor Is An Employee Or Self Employed For Federal Tax Purposes The Pastor S Wallet

Lutheran Pastor Salary Comparably

Solved As A Pastor Filing As A Contractor Is My Mileage To Be Under Personal Deduction Credits Tab Or Business Expenses I Have No 1099 My Income Is Housing Allowance Only

Tax Considerations For Ministers

Huge Infographic On The Business Of Mega Churches Tax Exempt Average Pastor Income 147 000 Many In The Millions Sees Gifts Of Bentleys And Rolls Royces Attendance Growing 8 Per Year Just Take A Look

Church Staff Salaries Guide With Real Numbers

A Pastor And His Compensation Your Church Matters Pages 1 12 Flip Pdf Download Fliphtml5

Should Priests And Pastors Pay Tax Quora

The Ultimate Church Compensation And Salary Guide Reachright

How Much Is Too Much To Pay A Pastor Huffpost Religion

How To Make Quarterly Estimated Tax Payments For Ministers The Pastor S Wallet